how to become a tax accountant uk

How to become an accountant Daniel Higginbotham Editor January 2022 View all accounting courses On this page 1. Advance in Your Tax Accountant Career 5.

Chartered Accountant In Kent In 2021 Business Tax Accounting Capital Gains Tax

Completing GCSE and A level qualifications is the first step in becoming a tax accountant.

. If youre looking to become a qualified Accountant or Tax Professional an apprenticeship is a great way to achieve your qualifications essential skills and invaluable work experience. Some employers seek out tax accountants that have masters degrees in accountancy or business administration. To become a chartered certified accountant with ACCA youll need to study for their qualification and have three years relevant work experience.

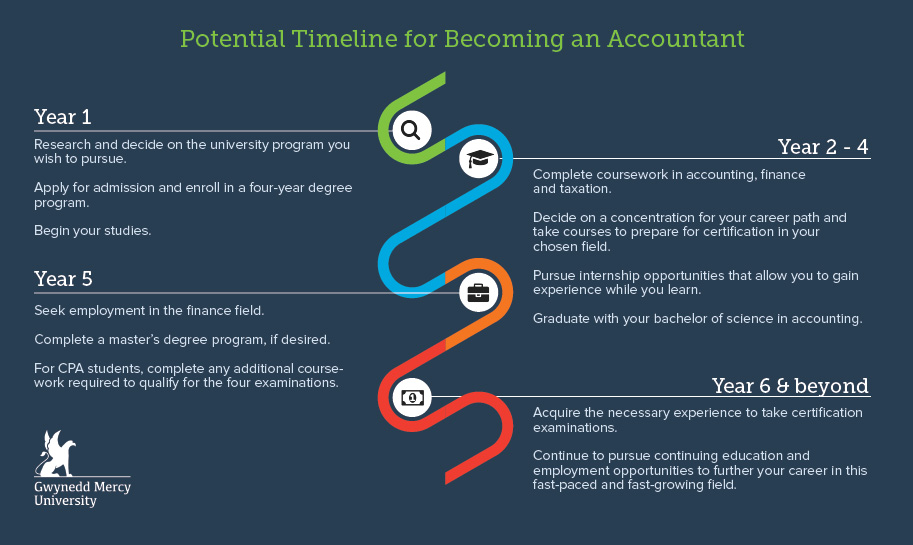

Get an Entry-Level Position as a Tax Accountant. After familiarizing yourself with all the roles and responsibilities of chartered accountant UK and the skills required by them we shall look at the steps on how to become a chartered accountant UK. How to become a tax accountant While degrees arent always required most accountants have a bachelors in accounting or finance.

Earn a degree Begin the process of becoming a tax accountant by pursuing a bachelors degree. Choose your accounting specialism 3. How to become a tax adviser.

While many accountants hold a university degree its not essential to. A guide to the routes to becoming an accountant and the qualifications you may need. You can become a chartered accountant by taking a degree followed by professional qualifications.

Study accounting at the undergraduate level. Consider earning a Master of Professional Accounting as an. Contact the team for more information Get in touch Why Kaplan.

Or you can work towards a degree apprenticeship as an accountancy or taxation professional. Get real-world accounting work experience if you can try and find an accountancy role whilst youre training and an employer to fund you. To become a tax.

This can get you started in. You will receive a letter from HMRC with a pin number which is. Find out more chevron_right Interested in tax.

Obtain an Accounting Degree Obtain a formal degree in accounting from an accredited college or university. Accounting is a common degree offered at most institutions of higher education but smaller colleges tend to focus on more general accounting while larger universities may offers tax concentrations or electives. Study the right accounting qualifications 2.

Study the required accounting qualifications. Working towards this role. The more common ways to become a tax accountant include.

How to become a tax accountant Here are the steps to follow for how to become a tax accountant. Tax Tax accountants help individuals and companies with all kinds of tax matters. Continued Education for Your Tax Accountant Career Path 1 Earn a Degree.

Here are the steps youll need to take if you plan to become an accountant in the UK. Here are the steps youll need to take if you plan to become an accountant in the UK. A survey by AccountacyAge found that the average salary for accountants across the UK is 63715.

To work as a tax accountant you can obtain an Association of Taxation Technicians ATT qualification while a prestigious Chartered Institute of Taxations CTA qualification can provide you with chartered status. On average accountants with a formal accounting qualification earn. Choose a major like accounting economics or tax law and aim to attend a university or college with an accredited program.

Get a bachelors degree in a relevant subject. Earn a Degree 2. Tax accountants who take courses in tax law are particularly well prepared for their profession.

Gain relevant GCSEs and A levels. How to become an accountant in the UK. To become a chartered accountant with ICAEW youll also need to complete at least three years of on-the-job training.

Secure a job or accountancy apprenticeship 4. Consider earning a Master of Professional Accounting as an. For trainee positions.

You will need at. Start your Training Start your apprenticeship after school or college after your first degree or after completing a business qualification. For each service you need to use youll need to enrol using your agent code or reference.

Its also possible to work your way up to chartered status by starting out in a more junior role for example as an accounting assistant while working towards professional. Pick a speciality focusing on a particular industry or field of accounting will help to distinguish yourself from the competition. Cpa Tax Returns Preparation Accounting Business Management Advisory Income Tax Return Tax Accountant Business Advisor.

Below are the steps generally required to begin and advance your Tax Accountant career. Get an Entry-Level Position as a Tax Accountant 4. You can get into this job through.

How to become a tax accountant. Choose a Specialty in Your Field 3. Specialist courses run by professional bodies.

Applicants are required to have at least three years of experience in a similar role.

Aat Level 3 Qualification Exam Support Synoptic Module Accounting Training Types Of Organisation Qualifications

How To Become An Accountant Learn The Steps Degrees Requirements

Tax Help For The Uk Self Employed Tax Help Freelance Tools Finance Blog

How To Become A Self Employed Accountant 5 Steps Babington Group Accounting Sculpture Lessons 3d Man

Pin By Meruaccounting On Accounting Blog Meru Accounting Business

Accounting Auditing Services In The Uk Audit Services Accounting Services Audit

Tax Director Resume Tax Manager Resume Becoming A Tax Manager Is A Vital Job To Applying For That You Must Manager Resume Accountant Resume Sample Resume

Accounting Training London City Training Uk City Training Uk

October Property Accountant The Ability To Analyse

Welcome To Astons Accountants A Company Which Provides Accounting Services Which Include Tax And Vat Instructions We Accounting Services Accounting Business

11 Questions To Ask An Accountant In The Uk Freshbooks Blog

Benefits Of Outsourcing Your Accounting And Tax Requirements Accounting Accounting Services Small Business Accounting

Chartered Tax Advisor Job Description Salary Benefits

What Role Do Accountants Play In Managing Taxation For Businesses In London Business Tax Accounting Accounting Services

Company Formation Accountant App Development Companies Top Digital Marketing Companies Best Digital Marketing Company

Cpa Tax Returns Preparation Accounting Business Management Advisory Income Tax Return Business Advisor Tax Accountant

Ideas To Manage Your Small Business Finances Business Finance Small Business Finance Accounting Services

11 Questions To Ask An Accountant In The Uk Freshbooks Blog

Tax Accountants London Are Specialized Tax Handlers Who Have Years Of Experience In The Field And They Are Prov Tax Accountant Accounting Services Business Tax